Low mortgage interest rates in Spain boost housing market

The Royal Institution of Chartered Surveyors (RICS) has just published a study on Europe's housing markets, and concludes that housing prices in Spain, France and Ireland continued to rise by double figures during 2004 and that there is little evidence to suggest that markets could crash in 2005.

The executive summary of the RIC paper says of Spain, France and Ireland, "Each year for the past three or four years pundits have predicted that the following year would herald a market slowdown in the booming residential markets of Europe. Yet, the UK apart, the slowdowns have failed to materialse. Low interest rates, instead, have continued to feed beliefs that capital gains can still be made out of housing and, to an extend, they have become self-reinforcing"

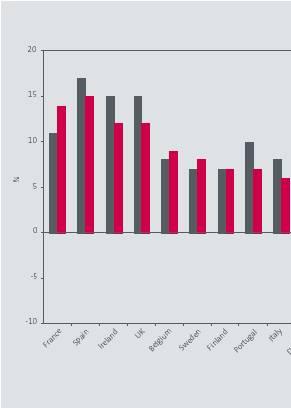

The table below, taken from the RICS Executive Summary, shows the rise in housing prices in European countries in 2003 (grey) and 2004 (red).

Unlike in the UK, low interest rates in Spain have helped to maintain the rise in housing demand, boosted by a steady increase in mortgage loans. Real mortgage interest rates in Spain were negative last year, averaging just 3.49 percent in Autumn 2004, and rates are presently 4 points lower than mortgage rates in the UK. which is one reason why more and more British buyers are choosing to take out a mortgage with a Spanish bank.

The RICS European Housing Review 2005 was put together by Michael Ball, professor of Urban and Property Economics at the Department of Real Estate and Planning at the Business School at Reading University. The full report can be downloaded free from here.

Related:

Latest news and figures on the property market in Spain

Mortgages for non-resident house-buyers in Spain

Spanish banks

Mortgages in Spain

The executive summary of the RIC paper says of Spain, France and Ireland, "Each year for the past three or four years pundits have predicted that the following year would herald a market slowdown in the booming residential markets of Europe. Yet, the UK apart, the slowdowns have failed to materialse. Low interest rates, instead, have continued to feed beliefs that capital gains can still be made out of housing and, to an extend, they have become self-reinforcing"

The table below, taken from the RICS Executive Summary, shows the rise in housing prices in European countries in 2003 (grey) and 2004 (red).

Unlike in the UK, low interest rates in Spain have helped to maintain the rise in housing demand, boosted by a steady increase in mortgage loans. Real mortgage interest rates in Spain were negative last year, averaging just 3.49 percent in Autumn 2004, and rates are presently 4 points lower than mortgage rates in the UK. which is one reason why more and more British buyers are choosing to take out a mortgage with a Spanish bank.

The RICS European Housing Review 2005 was put together by Michael Ball, professor of Urban and Property Economics at the Department of Real Estate and Planning at the Business School at Reading University. The full report can be downloaded free from here.

Related:

Latest news and figures on the property market in Spain

Mortgages for non-resident house-buyers in Spain

Spanish banks

Mortgages in Spain

Labels: economic and business news

1 Comments:

I´m spanish and I know the real-state problem in Spain.

I totally agree that mortgages have risen housing prices, and I think this is a big problem in the long term.

Salaries in Spain are much more lower than europeans´ ones, but housing prices are similar.

Morgages market depends on euro-zone conditions and low interest rates are related to savings in Germany. Spanish people spend and borrow lots of money and this is possible because of europeans´ savings.

Germany and other european countries are due to increase their government spending to boost economy. USA and Japan interest rates are due to increase as well. and this means that interest rates in Spain are due to go up.

Many spaniards are in a trap and they don´t know how terrible is it.

Many people ask the same question: Would it be possible a decrease in housing prices? If the knew the big problem they would ask this question: How are we going to afford the big economic slamp in those many households that won´t be able to keep on their lifestile?

Argentina and Spain will soon be nearer than they are now.

Antonio

Post a Comment

<< Home